1. The Security Industry is growing at a Compound Annual Growth Rate (CAGR) of 9%. Last year, UT was at $60.5 billion dollars. This year? $65.735 billion dollars. And in 2016, it's projected to grow to $85 billion.

2. Endpoint protection leads the way of 'Most actively deployed security technology' with 87%. Close behind is Web filtering/blocking with 86%, and Standalone Antivirus rounds of the top three with 84%.

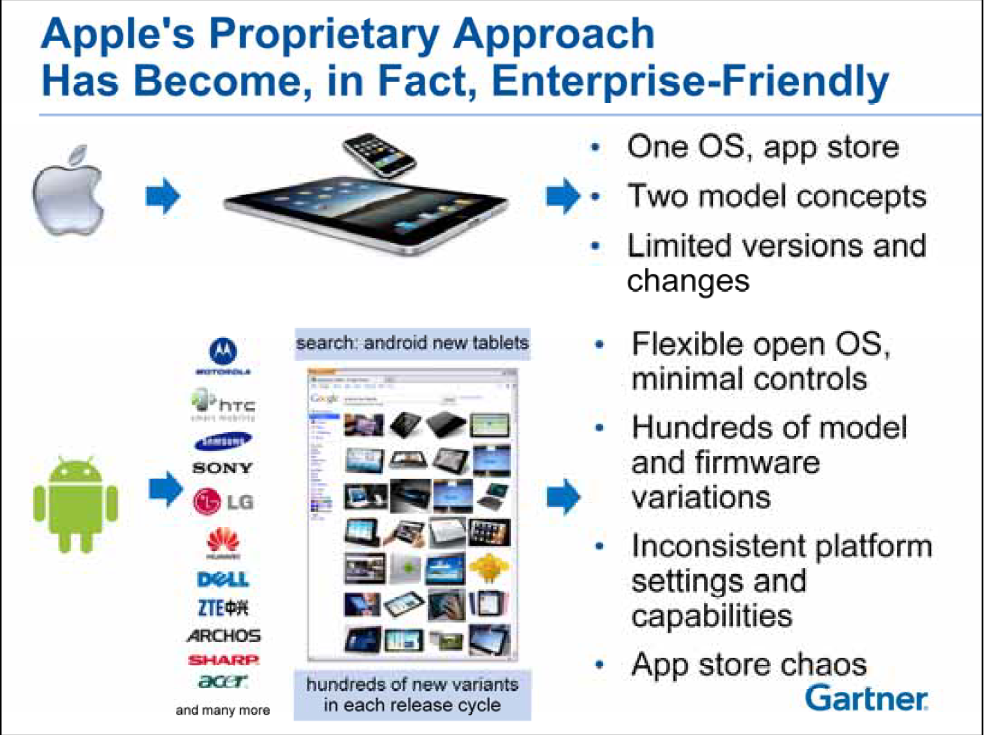

3. The least deployed security technology is Mobile Device Management, with just 45%.

4. When it comes to the top technology customers plan to deploy in the next year, Mobile Device Management is leading the pack with 51% (see below).

- Mobile Device Management = 51%

- Data Loss Prevention = 32%

- Advanced Threat Detection/Prevention = 26%

- Unified Threat Management = 25%

- Web filtering = 9%

- Endpoint Protection = 8%

6. Below is the list of key drivers for M&A transactions in the security industry.

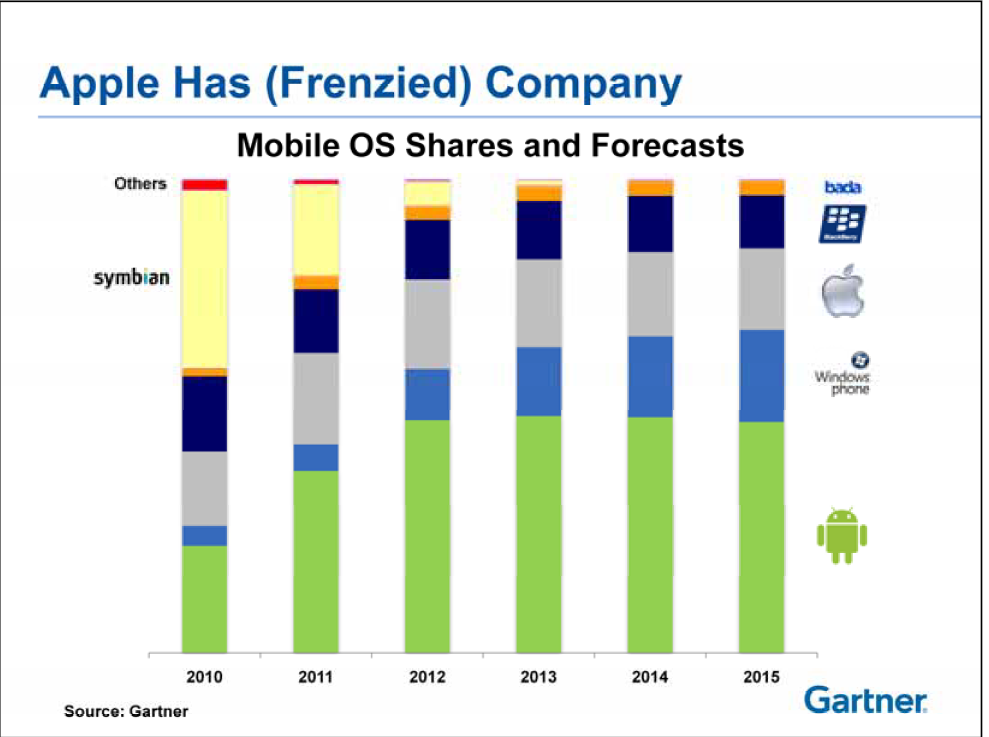

- Mobility – acquirers are seeking technologies that can secure and protect mobile devices

- Competition among the big vendors – greater competition and need to acquire to keep up

- Security Awareness – Is now a board level issue for companies and #1 Gartner requested inquiry is fielding questions from large end users about enhancing security

- Attackers Getting Smarter – Larger industry players need innovative startups to fill out their product portfolios

- Security Intelligence – that brings action to integration

- Product and Bundle Synergies – Buyers like security suites and Gartner recommends them

- G&A Efficiencies – Larger players know acquisitions can be profitable because of G&A cost reductions post integration

- Channel Synergy – Larger players can market newer acquired technologies through existing distribution and channel networks

- China – 19.1% CAGR

- APAC = 16.1%

- Latin America = 14.3%

- Middle East = 9.4%

Network Inspection and Reputation Analysis

- Gateway behavioral monitoring

- Local application control

- Data protection (from exfiltration)

- Fraud monitoring

- Adjusting marketing to be better aligned with the top trends like MDM.

- Partnering with third party vendors.

- Reviewing and enhancing product capabilities to support BYOD and virtualization security concerns.

- Examining product roadmaps and align them to increase function/features around key market interest areas such as Mobility and Security Context.

- Driving changes in your portfolio to deliver SaaS – customers are significantly more interested in paying for security by the drink rather than as an upfront CAPEX.

- Considering advanced uses of security context – such as real time policy enforcement in response to actionable threats.

- Trying to create a leading position as a point solution in security context/intelligence or mobile device protection to prepare your business for acquisition.

(Source: Gartner)